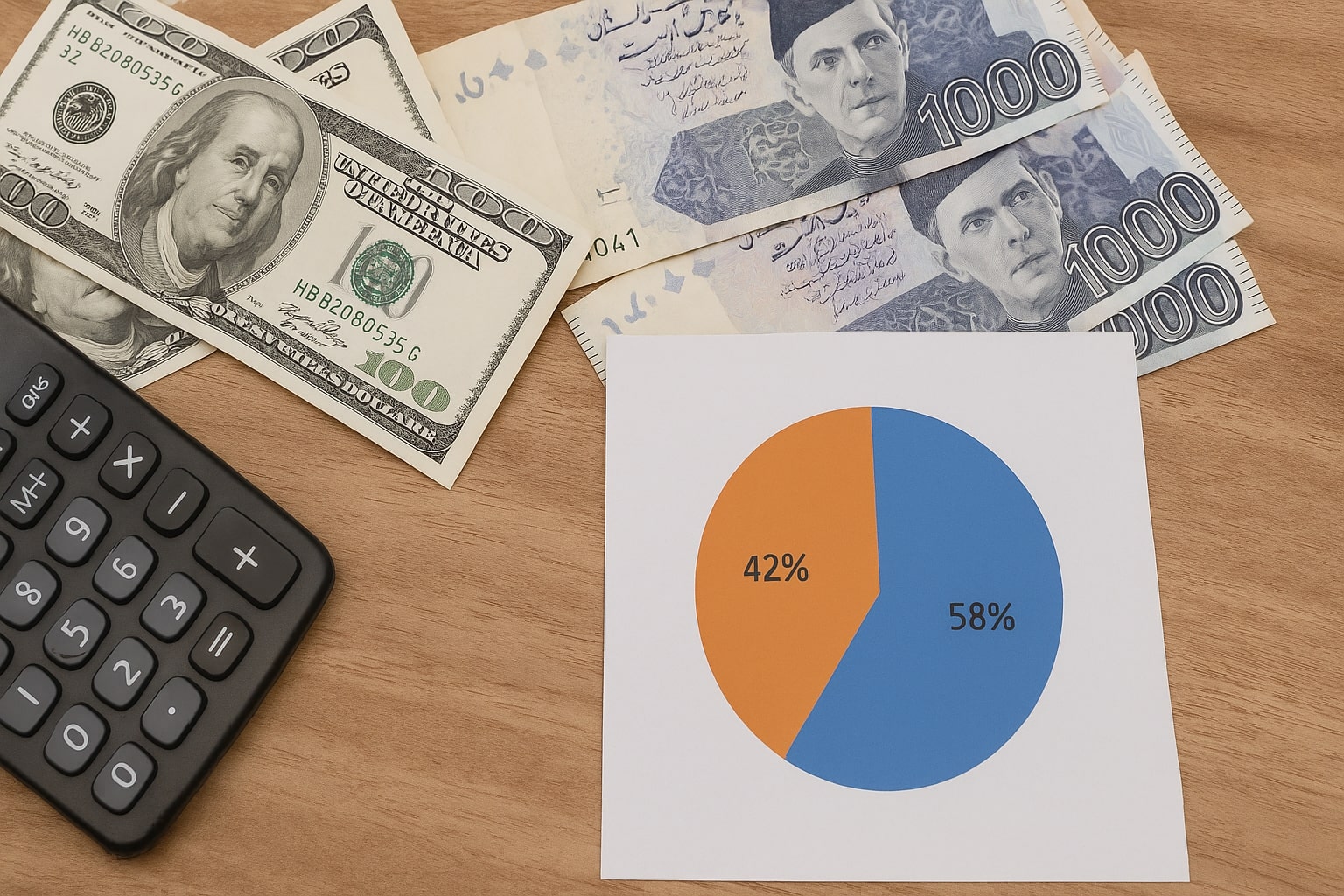

Pakistan’s international financial obligations currently total $130 billion, with the U.S. dollar accounting for 58% of this significant debt. This situation reflects an alarming fiscal condition in the country and leaves its economy considerably vulnerable.

The nation’s financial burden to the rest of the globe represents around 38% of the country’s gross domestic product (GDP), a figure which is worryingly high. The situation demonstrates that the country’s ability to generate revenue is dwarfed by the magnitude of its external liabilities.

This state of affairs also reveals the disproportionate influence that the U.S. dollar has on these debts. Currently, Pakistan’s obligations denominated in the U.S. dollar make up approximately 58% of the $130 billion total. The preponderant role of the dollar in the country’s debt makeup may complicate the nation’s ability to meet these obligations, in the event of exchange rate fluctuations.

Pakistan’s reliance on borrowed resources for its fiscal expenditure intensifies its exposure to the possible negative effects of exchange rate changes. If the value of the U.S. dollar were to increase dramatically against the Pakistani Rupee, this could escalate the local currency equivalent of the debt, further straining the country’s finances.

The excessive amount of debt also restricts the government’s financial capacity for development projects and social welfare programs. The bulk of its revenues goes towards servicing these debts rather than towards the progression of the country. Hence, while debt plays a crucial role in the development of any nation, excessive indebtedness accompanied by too little or no productivity can hamper any country’s overall development to a great extent.

Furthermore, it is a continued trend as Pakistan’s ratio of external debt to GDP has been significantly high over the last decade. It’s an ongoing challenge for the government to balance the country’s development needs with repayments.

This debt burden has a range of implications for the country’s economy, both in the short and long term. With regard to the short term, the amount of debt raises questions about the country’s financial stability. In the long term, the excessive borrowing triggered by the hefty amount of debt places a hefty burden on future generations who will be left with the repayment.

Pakistan’s economy is at a crossroads, grappling with the challenges of a high debt burden and a struggle for debt sustainability. Necessary measures are being discussed to curtail the propagation of a further increment in these international obligations. But, these measures will require effective plagiarism and sustainability to ensure the country’s economic betterment.

The critical situation emphasizes the need for effective economic policies and efficient management of the country’s fiscal resources. It also underlines the importance of fostering domestic investments and driving economic growth as a method for repaying these large external liabilities.

In conclusion, this situation not only necessitates an immediate solution to the problem but also calls for sustained efforts to promote economic growth and reduce dependence on external borrowing in Pakistan. It’s high time the government focused on sustainable financial strategies to promote economic resilience against mounting debts and achieve financial independence. Read more

Leave a Reply